Asset Protection

Retirement doesn’t mean that it’s time to stop growing. Same holds true for your money. It should mean, however, that it’s time to stop taking unnecessary risk.

We specialize in helping retirees protect their retirement assets while continuing to move forward.

WHY ASSET PROTECTION IS IMPORTANT

For retirees, the assets accumulated over a lifetime are vital for ensuring a secure and comfortable future. These assets are not just a source of income but also a safeguard against unforeseen events or expenses. However, protecting these assets requires time, knowledge, and vigilance—resources that not everyone possesses. Without a dedicated focus on asset protection, retirees risk erosion, depletion, or loss of their hard-earned savings, which could jeopardize their financial stability during their retirement years.

WHAT WE CAN DO FOR YOU

Understanding Your Objectives: Every retiree has unique financial goals, whether it's ensuring a steady income, preserving wealth for future generations, or covering healthcare and unforeseen expenses. Our first step is to understand your specific needs and objectives to create a tailored asset protection strategy that aligns with your retirement plans.

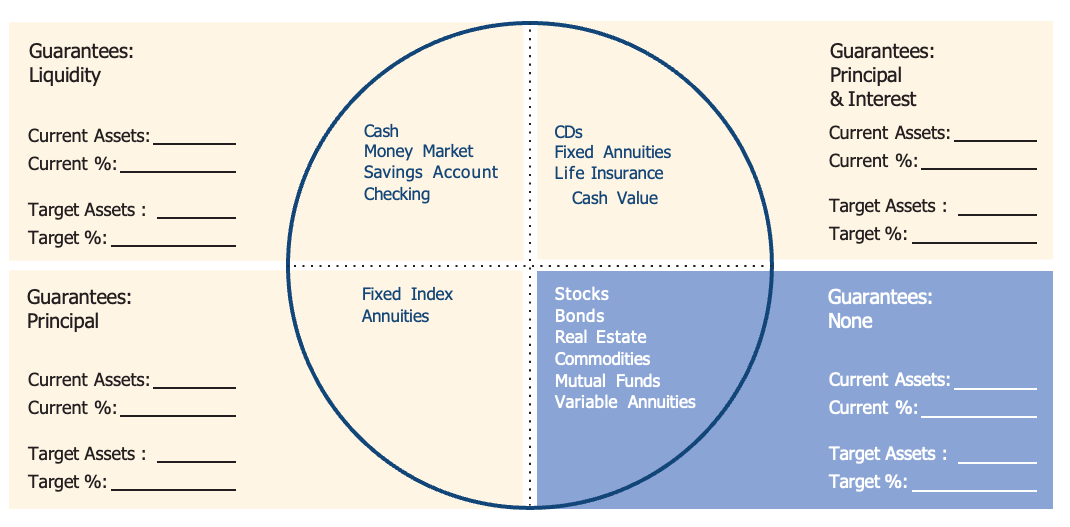

Helping You Choose the Right Asset Mix: Protecting your assets involves selecting an optimal mix that balances safety and returns. We guide you in choosing investments that prioritize security and sustainability, ensuring that your assets are well-positioned to meet your long-term needs without unnecessary risk.

Creating a Comprehensive Asset Protection Plan: We develop both a Strategic Asset Protection Plan (SAPP) and a Tactical Asset Protection Plan (TAPP). These plans are designed to provide a long-term vision for preserving your wealth and a short-term approach for adjusting to market fluctuations and life changes.

Building a Safe and Sustainable Portfolio: While many retirees may be tempted to manage their own investments, doing so without professional guidance can lead to significant risks. We build a carefully curated portfolio that emphasizes asset protection, focusing on lower-risk investments such as bonds, dividend-paying stocks, and other stable vehicles that align with your retirement goals.

Monitoring and Maintaining Your Portfolio: Effective asset protection is not a one-time task; it requires ongoing attention. We handle the day-to-day monitoring and management of your portfolio, making adjustments as needed to ensure that it continues to meet your financial objectives while minimizing risk.

Evaluating Performance with a Focus on Stability: Our focus is not only on growth but on maintaining the stability of your assets. We continually evaluate how your investments perform against relevant benchmarks, ensuring that they remain aligned with your asset protection goals.

Mitigating Risks Proactively: Our Asset Protection strategy includes robust risk management practices. We identify potential risks early and work with you to take appropriate actions to protect your portfolio from unforeseen downturns or changes in market conditions.

Regular Reviews and Updates: Asset protection requires adaptability. Through regular reviews and open communication, we ensure that your asset protection strategy evolves with your changing circumstances, keeping your retirement secure and your financial goals within reach.

Transition from Diversification Portfolio to Asset Allocation

(or Asset Protection)

Asset allocation determines the percentage of your investment funds that you should invest in a particular quadrant based on a number of factors. For example, the no-guarantee quadrant is more volatile, so younger investors are typically able to invest more in those categories.